Personal finance is more relevant than ever to Pakistanis as they enter the year 2024. With inflation creeping up and economic situations changing, proper financial planning leads to a stable future for them. The blog focuses on efficient saving and investment strategies that specifically suit the Pakistani context and takes you through the contemporary financial scenario.

The process starts with covering a holistic budget; this is what forms the core of effective personal finance. Such a budget ensures that one can know where every penny comes from and where it goes, and hence the person knows where to save and how to articulate goals toward acquiring financial security. Probably the most prudent action in financial planning is establishing an emergency fund, which gives a cushion during uncertain times.

Then, we are taught how to save smartly by utilizing digital bank tools and savings plans. Lastly, the blog teaches me about a well-known budgeting law named the 50/30/20 rule. With this technique, one can distribute his or her income.

The other crucial factor is investment, where different alternatives like investing in the stock market, real estate, mutual funds, and digital investment platforms will be understood. Each investment channel is explained with tips to earn maximum returns avoiding risks in real time.

The blog also handles retirement planning, that must be started early and be taken into consideration by incorporating voluntary pension schemes. Finally, it emphasizes continuous education and keeping abreast of the financial trends because knowledge proves to be of importance in making decisions.

Whether you want to save for a home, retirement, or maybe a child’s education, this blog is filled with useful information and hands-on guidelines about navigating the financial landscape in Pakistan. With a proactive approach to managing personal finances, you can create a secured financial future and bridge the gap of financial freedom with confidence.

Personal Finance in 2024: Smart Saving and Investment Tips for Pakistanis

With this new year ushering into 2024, it goes without saying that personal finance is more relevant than ever to the lives of individuals in Pakistan. Inflation, currency devaluation, and rising costs of living pose a significant challenge in letting people move toward an economically stable future. In the following blog, you will find smart saving and investment strategies in the Pakistani context, guiding you to be well ahead of the curve in the financial domain.

Understanding the Financial Landscape in 2024

Against this backdrop, it would be prudent to first understand the current financial situation of Pakistan. Even in 2024, inflation seems to continue being a big problem that highly impacts the purchasing power and savings. What’s more, due to the change in the economy through latest technologies, traditional savings and investment tools are becoming out of date.

As we adapt to these changes, we also have to create a secure financial life regarding personal finance, budgeting, saving, and, above all, providing the best and smartest savings and investments.

1. Create an Overall Budget

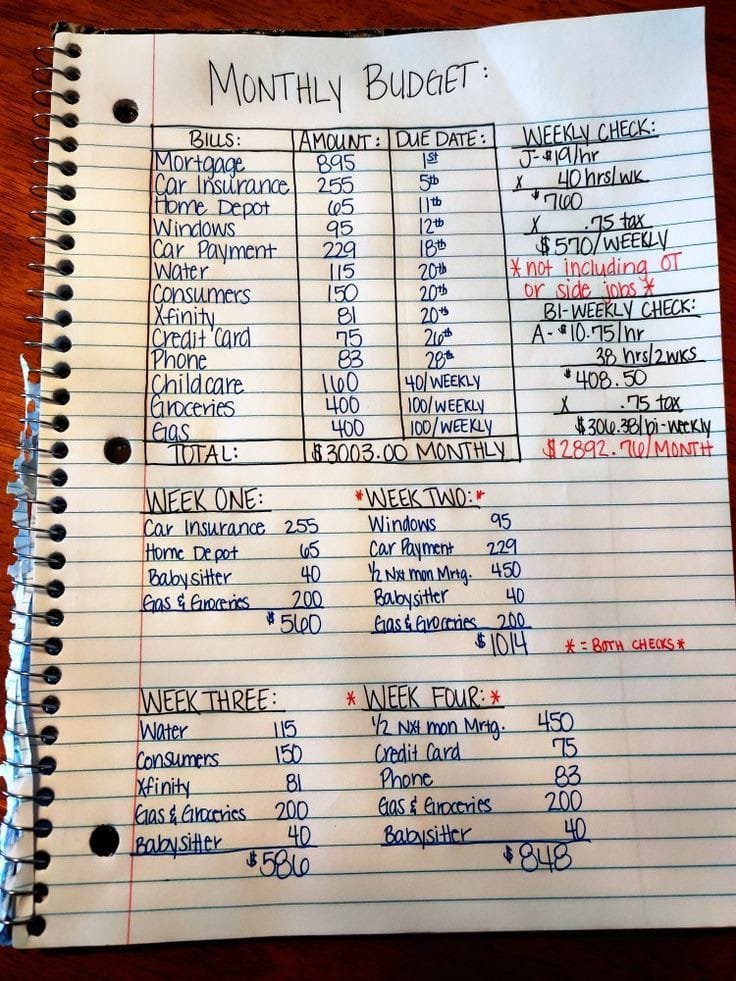

An effective budgeting plan is actually the base of effective personal finance. First, count your income and expenses in as much detail. Here’s how to make a budget that will work for you:

Assess Your Income and Expenses

Income Streams: All sources of income such as salary, freelance work, side businesses, etc.

Fixed Costs: You should note your rent, utilities, and loan payments.

Variable Expense: Tracking Variable expense accounts would include items such as groceries, entertainment, and transportation.

Classification of Your Expenses

You could also classify your expenditures to see just where your money is going. This will help you know where to curb. You can either use budgeting apps such as YNAB (You Need a Budget) or get some other local applications available in Urdu to make the task easier.

Set Financial Goals

Define short-term and long-term financial goals. Whether you want to save for a summer vacation, perhaps buying a house, or provide for retirement, clear objectives will propel you to stay on your budget.

2. Create an Emergency Fund

Building an emergency fund is one of the crucial steps in managing security during uncertain times. The amount that should be put aside for an emergency varies from three to six months’ living expenses. Here’s how you can do it:

Start Small and Stay Consistent

Start very small-10 percent of your income each month. Use automatic transfers into a savings account so this becomes easy.

Choose the Right Savings Account

Look for a high-interest savings account or a fixed deposit account with a respectable bank. In sure it is accessible in an emergency, but not so accessible that you are tempted to withdraw for non-essentials.

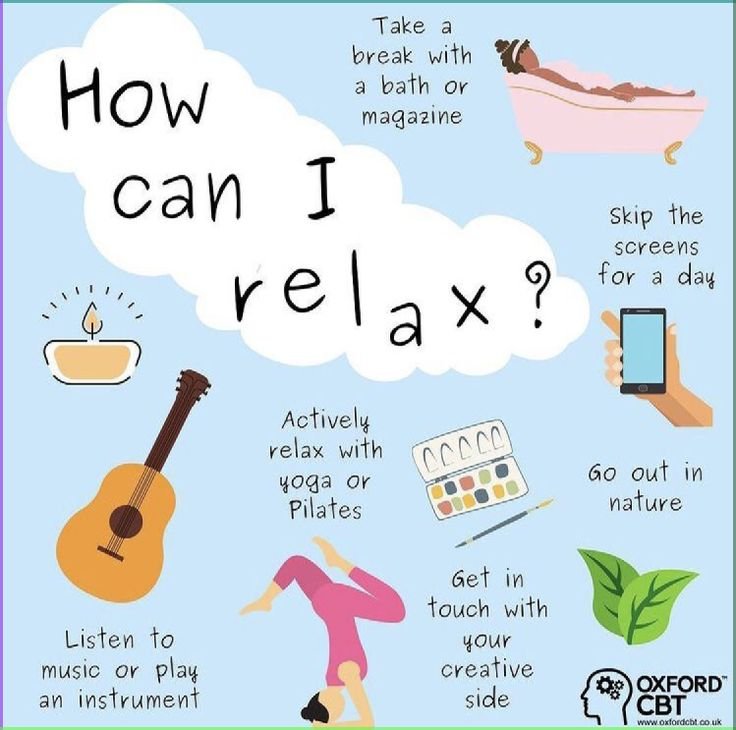

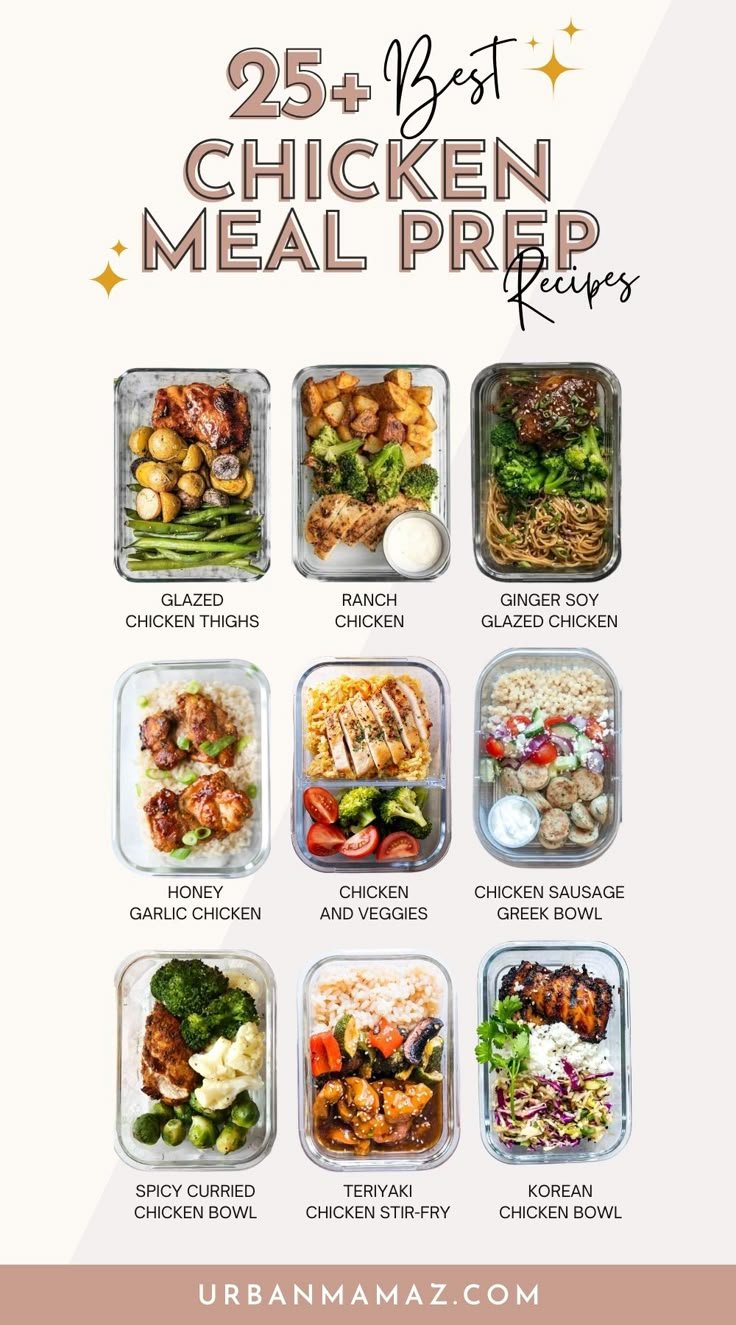

3. Savvy Saving Tactics

Savings is a wise pre-requisite to achieving your financial objectives. Here are some savvy saving strategies tailored for the Pakistani context:

Take advantage of digital banking facilities

Most banks in Pakistan offer you options to save better through online banking. Use savings applications to track your savings towards a goal, and receive alerts on your spending limits.

Saving Plans

Enroll in a saving plan or mutual fund. Most banks provide some very attractive saving schemes that are like profit-sharing accounts or recurring deposit accounts, which give you a higher interest rate compared with a simple savings account.

Implement the 50/30/20 Rule

The simplest budgeting rule is that 50% of one’s salary is to be utilized as a necessity, 30% for discretionary spending, and 20% for savings. This rule will help you balance enjoyability in life with security in the future.

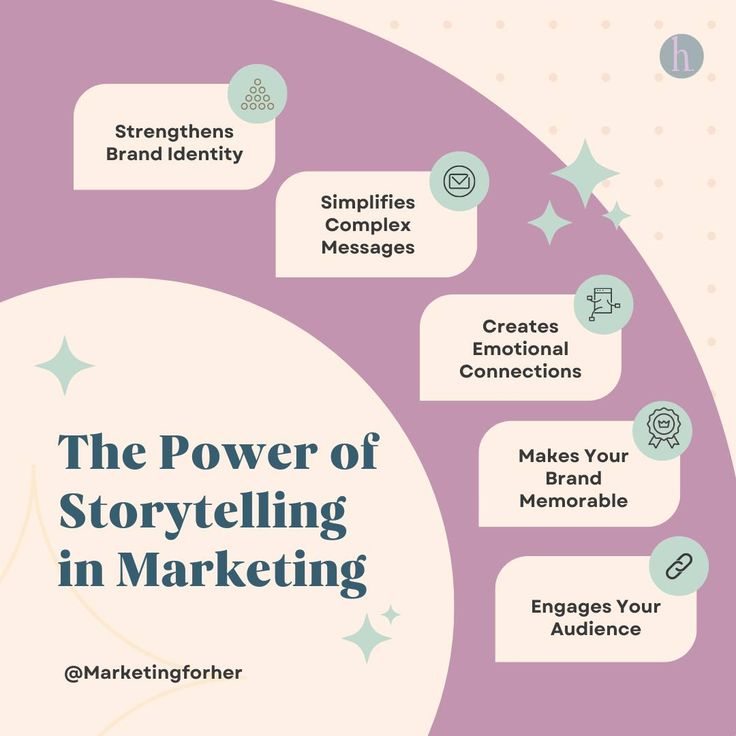

4. Investment Basics for Pakistanis

Investments form a very important source to raise your wealth and avoid blowing off due to inflation. Some of the popular investments in 2024 for Pakistanis include the following:

Stock Market Investments

More than a time frame, investing in the Pakistan Stock Exchange (PSX) can be highly rewarding. Here’s how to get started:

Research and Education Before investing, educate yourself on stock market fundamentals. Online resources, courses, and webinars can all be useful for insights.

Diversification Don’t put all your eggs in one basket. Invest your portfolio across various sectors such as technology, healthcare, and consumer goods to counter risks.

Long-Term Perspective: Security investments in the stock market are quite volatile. But, having a long-term investment strategy will help you smooth out the gyrations of the market.

Real Estate Investment

Real estate is still a good investment in Pakistan. How to navigate this market?

Location Matters: Invest in properties in growing areas. Cities such as Karachi, Lahore, and Islamabad are spreading out, making it a pretty welcoming place for real estate investment.

Rental Income: Now that you have bought properties that you can rent out, rental income can bring in steady cash inflows while offsetting much of your investment costs.

REITs. If you cannot directly invest in property, then do it through the route of REITs. These are companies which either own or finance income-generating real estate. They enable you to invest in real estate without having to purchase physical property.

Mutual Funds and Exchange-Traded Funds (ETFs)

Mutual funds and ETFs is an excellent way of investing without managing individual stocks. They collect money from several investors and use them to purchase a diversified portfolio of assets.

Professional Management: The portfolio managers take care of the investments and thus make it easy to begin for novices.

Diversification: Mutual funds and ETFs invest in a large number of securities, thus diversifying the risk.

Affordability: The good thing with most funds is that you can start investing with the least amount of money and it is accessible to most people.

5. Explore Digital Investment Platforms

This is a year, 2024, which can be seen as a future for investment in Pakistan. Even digital investment platforms have become popular with minimum fees to tap into investments. Consider the following:

Robo-Advisors

It is an automated investment management service that takes into account your financial goals and risk tolerance. It studies the customer’s financial situation, offering a strategy in terms of optimal investments.

Peer-to-Peer Lending

P2P lending websites allow you to lend directly to borrowers who pay interest on your investment. It has risks but can be quite profitable if managed prudently.

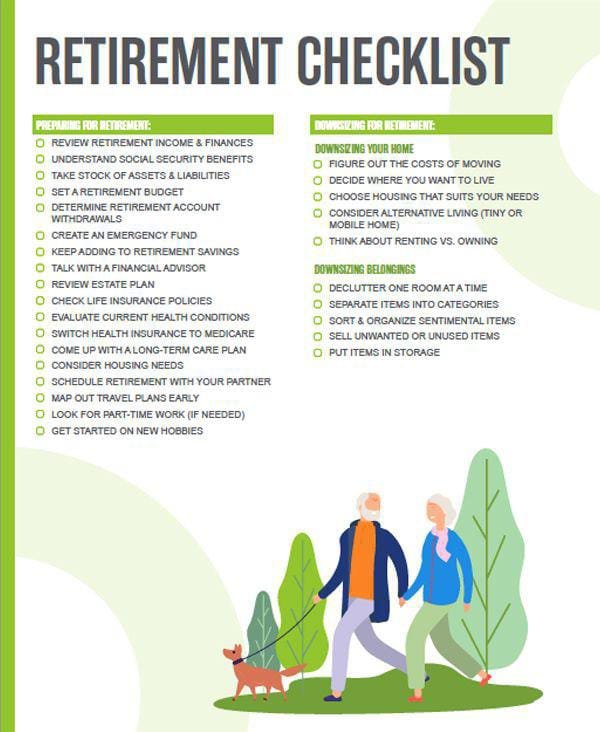

6. Retirement Planning

Well, planning for retirement starts very early. Retirement may seem far away, but it calls for strategic planning:

Start Early

The sooner you start saving, the more time your money has to grow. If you are offered a retirement plan by your employer, take advantage of it. Otherwise, open a separate account strictly for retirement saving.

Consider Voluntary Pension Schemes

Pakistan offers a number of voluntary pension schemes (VPS) that enjoy tax benefits and encourage retirement savings. Research different plans to find one that aligns with your financial goals.

Track Your Savings

Regularly review your retirement savings to make sure you’re on track to meet your goals. Adjust your contributions or investment strategies as needed.

7. Stay Informed and Educated

Stay updated. There’s nothing wrong with monitoring financial news, subscribing to personal finance blogs, or joining online forums. Education is a key towards making wise decisions about your money.

Workshops and Seminars

Attend seminars and workshops on matters of money and investment strategies. Such events often offer important insights, thus networking opportunities.

Engage with Financial Advisors

If you aren’t sure about the right financial plan, you should consult a financial advisor. A financial advisor will guide you on your basis and provide you with tailored advice for your respective needs and goals.

Conclusion

Personal finance is the need of the hour for a stable future in Pakistan as we step into 2024. Creating an overall budget, building up an emergency fund, and exploring smart saving and investment strategies will be able to let you achieve this.

Take advantage of the opportunities presented by the stock market, real estate, and digital investment platforms to increase your wealth. Remember that the only key to financial success is consistency, education, and adaptation. The moment you take control of your finances today, you will be ready to face tomorrow’s challenges and land your financial goals. Whether you want to save for a house of your dreams, retirement, or a chance at quality education for your child, smart financial decisions will lead you to prosperity.

Wirklich gut geschrieben und auf den Punkt gebracht.

Velmi hodnotný článek, děkuji za skvělé informace.

Bravo pour cet excellent article, c’est vraiment très bien fait.

Please provide me with more details on the topic

Hiya, I am really glad I’ve found this information. Nowadays bloggers publish just about gossips and internet and this is actually irritating. A good site with exciting content, that’s what I need. Thank you for keeping this website, I will be visiting it. Do you do newsletters? Can not find it.

Awesome blog! Is your theme custom made or did you download it from somewhere? A theme like yours with a few simple adjustements would really make my blog stand out. Please let me know where you got your design. Appreciate it